41+ should i refinance to a 15 year mortgage

For a 15-year loan for instance multiply your revised monthly payment amount by 180 for 15 years x 12 months. The timing might be ideal for refinancing to a 15-year loan.

4 Reasons To Refinance Your Mortgage Zillow

Web A 30-year loan on a 400000 mortgage today has an average rate of 3204 while the rate for a 15-year loan for that same 400000 loan is just 2637 saving the homeowner who switches.

. But not only is the interest rate on 15-year. Keep in mind that youll generally need good to excellent credit stable income and a low debt-to-income DTI ratio to. Yes your monthly payment will increase if youre refinancing from a 30-year loan into a 15-year loan but the bulk of that money is going toward the principal.

This story has. Web The borrower would need to buy a cheaper housea 200000 mortgage at 4 for 15-years results in a 1479 payment. However you also learn those higher payments can save you 83000 in interest and allow you to pay off your loan 12 years sooner.

If youre stuck in a 30-year mortgage with high interest rates the gains you make by refinancing to a 15-year fixed-rate mortgage make it a no-brainer. Web Refinancing to a 15-year mortgage will generally raise your monthly payments but save you money on interest in the course of your total repayment period. Web A 15-year fixed mortgage is a home loan with an interest rate that stays the same over a 15-year period.

Rates as of March 2 2023. Web Refinancing from a 30-year fixed-rate mortgage into a 15-year fixed loan can help you pay down your loan sooner and save lots of dollars otherwise spent on interest. To refinance your loan you also need to pay 3000 9000 in closing costs 2 6 of your loan balance.

The rates listed above are averages based on the assumptions here. Actual rates listed within the site may vary. Web The scenario below shows how a 5-year-old loan might look if you refinance at todays 15-year refinance rates.

Web If you refinance to a new mortgage with a 4 interest rate your monthly mortgage payment would fall to around 1275. Web Refinancing to Get a Shorter Loan Term If you refinance from a 30-year to a 15-year mortgage your monthly payment will often increase. These factors all play into the decision to refinance to a 15-year mortgage or not.

Web Monthly principal and interest payments for a 15-year fixed-rate mortgage run about 50 higher than on a 30-year home loan. Web For 15-year fixed refinances the average rate is currently at 641 an increase of 8 basis points from what we saw the previous week. Web A 15-Year Loan Can Yield Big Savings.

Web Using the same 200000 mortgage as an example that 30-year fixed loan would initially cost you about 666 per month in interest. Web They run the numbers and find that refinancing to a 15-year mortgage while obtaining the same 4 rate and 300000 loan amount would increase your monthly payment by almost 800. Web If you have a home loan from the Federal Housing Administration FHA and are eligible to refinance refinancing into a conventional 15-year mortgage can eliminate your ongoing mortgage.

On the other hand a 30-year loan for 250000 would result in a. Web Your mortgage has more than a 15-year term such as 30 or 40 years. For example a 15-year fixed rate mortgage for a home valued at 300000 with a 20 down payment and an interest rate of 375 the monthly payments would be about 1745 not including taxes and insurance.

Web If your original mortgage is a 30-year term or more then refinancing is a good way to get to the ultimate goal of locking in a 15-year fixed-rate mortgage. You also have to pay property taxes insurance and if you put. With a 15-year fixed refinance youll have a larger monthly.

Yes it might mean a slightly higher monthly payment. Your loan balance remains at 150000 and your new monthly mortgage payment is 125770. Web Whether refinancing to a 15-year mortgage is a good idea differs for each homeowner.

Web The average rate for a 15-year refinance is 607 as of December 2022. On the other hand youd start out paying about 498 per month in interest by choosing a 15-year fixed mortgage. Youll own your home.

That saves you 600 a month and almost 7200 a year. Thats because you have basically the same amount of time left on the. Web 30-year fixed jumbo.

Youll pay off your house quicker and save a ton of money since youre. Every borrower will have a different loan amount interest rate financial goal and time they wish to stay in the home. Web If you have 15 years left on your 30-year mortgage.

We say 15-year fixed-rate mortgages are the goal because theyre better for you than 30-year mortgages. Web You decide to refinance to a 15-year mortgage with a new interest rate of 59. As such going from a longer loan to.

You have a high-interest rate loan. Web If your current mortgage has private mortgage insurance PMI you could refinance into a 15-year and remove the PMI as long as you have enough equity. From paying for home improvements to paying for college or just lowering your monthly payment there are many reasons people refinance their mortgage.

Getting rid of the PMI will lower your payment and a 15-year payment may not be that much different because you wont be paying mortgage insurance. Not only do interest rates tend to be lower on 15-year loans but youll pay down that debt at a much faster pace. Web Add the cost of refinancing -- your closing costs will typically amount to about 2 to 5 of the loan value -- to the cost of your new payments.

Is Refinancing A Car Worth It That Depends On Your Strategy

Refinance Rates For Feb 15 2023 Rates Rise Flipboard

Should I Refinance To A 15 Year Mortgage Mortgages And Advice U S News

Is Refinancing Into A 15 Year Mortgage A Good Idea Bankrate

6 Ways To Know Whether A 15 Year Mortgage Is Right For You Bankrate

Mortgage Hacks To Painlessly Pay Your Mortgage Off Early

Is Refinancing A Car Worth It That Depends On Your Strategy

3 Questions For Anyone Refinancing To A 15 Year Mortgage Smartasset

How To Score The Lowest 15 Year Mortgage Rate For Your Refinance

Should I Refinance My Mortgage Forbes Advisor

Innovate Toronto By Sven Boermeester Issuu

Should You Refinance Into A 30 Year Or A 15 Year Mortgage During The Pandemic

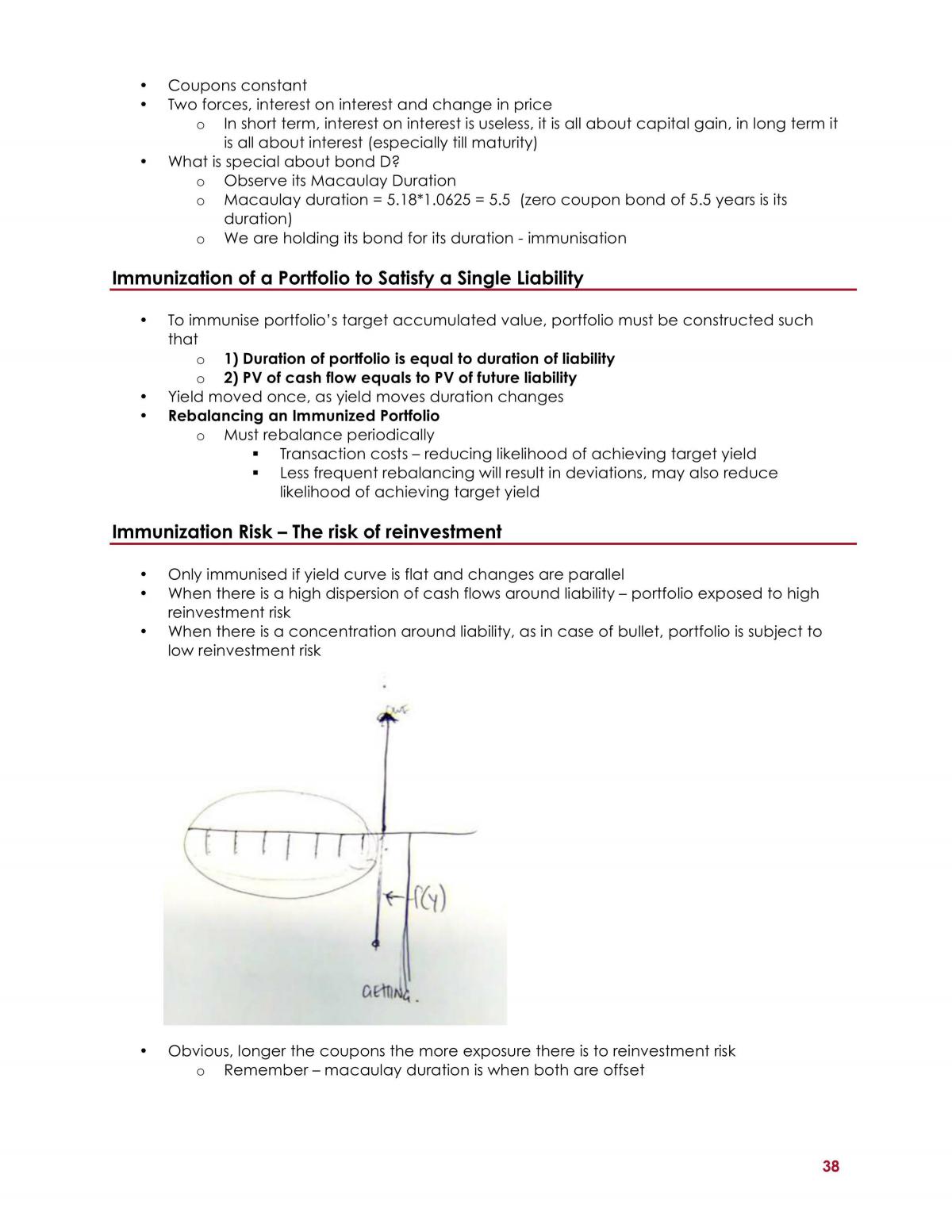

Finc3018 Full Set Of Notes Bank3011 Bank Financial Management Usyd Thinkswap

4 Reasons To Refinance Your Mortgage Zillow

How To Refinance A Mortgage A Guide To Mortgage Refinancing

Should You Refinance Into A 30 Year Or A 15 Year Mortgage During The Pandemic

When Should You Refinance Your Mortgage Bankrate